ENXTPA-ALHGR

shares outstanding (diluted). ~15,2M

Market cap. ~€80M

EV. ~€100M

Revenue FY24. ~€13.2M

EBITDA FY24. ~N/A

Context

Cement is one of the most widely used materials in this world. Most of us live inside a cement block, and many more will do in the near future. Furthermore, cement is also very carbon-intensive to produce. For instance, 1 ton of cement produced, releases around 900kg of CO2 into the air. Putting it in simple words, to make cement one needs to burn limestone in a furnace at very high temperatures during 18 hours. So, what if we can modify the cement composition and produce it in a cold process (without burning raw materials)?

In this context, it makes sense that many start-ups are popping-up, showing they have produced some kind of ‘greener’ cement; which maintains the strength of its traditional Portland brother but is less carbon-intensive to make. Many of this start-ups are still in the developing phase, some have partnerships with large cement manufacturers, and others, like Hoffmann Green, are already entering the commercial space.

Set up in 2014 by David Hoffmann, a chemical engineer, and Julien Blanchard, an entrepreneur, Hoffmann Green, produces and markets innovative, clinker-free, decarbonized cements, a complete break with traditional Portland cement.

Company Overview

Hoffmann Green has developed a ‘clinker-free’ cement using co-products for which there is currently little or no recovery (blast furnace slag from steel production, clay from the washing of aggregates or clay sludge, gypsum from construction site excavation material…). The absence of clinker, combined with Hoffmann’s patented manufacturing process, reduces the carbon footprint fivefold compared to conventional Portland cement (CEM I).

Bussines strategy

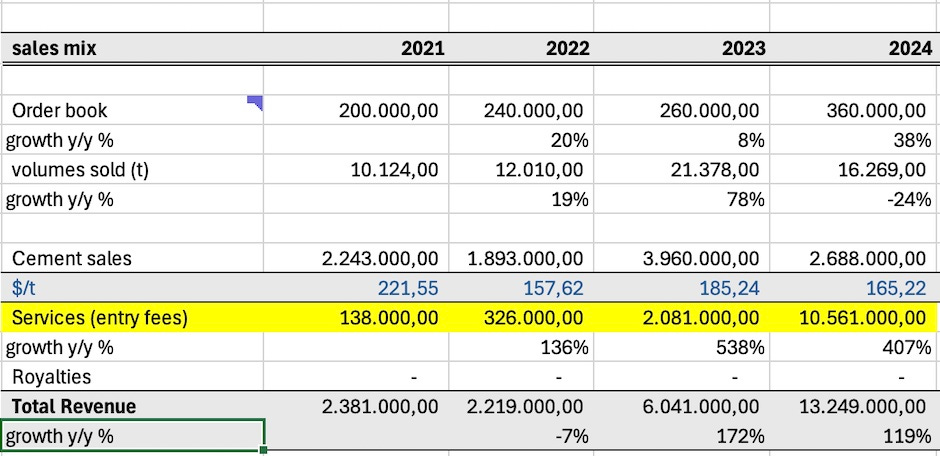

Cement Sales segment (~€2.7M sales FY24):

‘H1’ and ‘H2’ sites already producing cement in the west of France, with full capacity of 450k tons of cement per year. This plants are currently in production, and volumes have reached ~19k tons of cement during H1 25. This cement is sold to construction companies and distributors.

‘H3’ plant expected construction by 2028 in the east of France. This plant will add another 400k tons capacity per year. The budget for the plant is estimated at €25M, which is not a big amount. In my opinion, this low initial CAPEX is a competitive advantage, as their licensing partners can replicate this plants easily in other countries (more on licensing later).

One of Hoffmann’s plants in France

As cement is a heavy product and its transport costly, the operating radius of a cement plant does not exceed 300 km by land. So this product is intended to be sold mostly inside the French borders, for French operators. Most of the sales are through contract agreements, and just a small number of volume is sold at ‘spot’.

Examples of contracts signed for the sale of cement:

Four-year agreement with Trebocat Group, a builder of single-family homes in France.

Partnership with Les Mousquetaires Group for the cement distribution via a network of B2B/B2C distribution centers.

But here comes the interesting part: would the company miss international expansion only because they cannot export the product due to high costs? Of course not. But how then they’ll sell to, for example, Saudi Arabia? The answer is Licensing!

Licensing segment (Entry Fees and future royalties) (~€10.5M sales FY24):

Some numbers:

Entry fees is the amount Hoffmann earns when a contract with an international operator is signed. The international partner will then bear all the costs of building a new Hoffmann cement plant in its own country (~€25M CAPEX), according to Hoffmann’s parameters, then produce future volumes of cement and pay Hoffmann royalties over the revenue generated. Hoffmann will retain some of the mixture for the cement and it will sell it to the partner for the production process. As you can see on the image above, they are being quite successful at signing entry fees, generating triple-digit sales growth. But why this success?

The company targets markets where strict regulatory compliances are in place, and government plans to phase-out traditional Portland are pushing the construction sector to use more eco friendly materials. This markets are the EU, U.K, the USA and Saudi Arabia. Companies there have targets to improve their carbon emission status and waiting until the best eco-friendly solution arrives is not an option. What makes Hoffmann different here, and makes it able to capture this opportunity, is that they are actually selling the product, not like other small companies still on the trial phase.

Examples of licensing contracts signed:

“Exclusive licensing agreement with the SHURFAH group, for a period of 22 years, to build several “H2” type units in Saudi Arabia. In return for the industrial and technological transfer and this exclusivity, the Company will receive an entry fee and annual fixed and variable royalties from SHURFAH based on the revenue generated by the marketing of Hoffmann cements in Saudi Arabia.”

“Major license agreement in the United States. This exclusive license agreement for a period of 30 years, with effect from 28 June 2024, will see the construction of several vertical production units of the “H2 unit” type in the United States to support the decarbonization of the construction sector in the region. In

return for the industrial and technology transfer and this exclusivity, the Company will receive an initial fee of up to €20 million (including €2 million guaranteed) as well as fixed and variable annual royalties based on revenue generated by the marketing of Hoffmann cements in the United States.”

Outlook

By 2030, the company ambitions to sell 1M tons of cement per year with three operating production sites, corresponding to a 6% market share in France. That means the three plants would work at full capacity. If so, for me that would mean that the home construction market pipeline is strong. Well, that is dependent on inflationary pressures and interest rates, let’s see.

On the international front, by 2030 Hoffmann plans to have signed another 5 contracts with international partners. If those are big, like the one signed in the USA, they could add €50-100M in entry fees. Apart from the entry fee, royalties from this contracts takes time to roll over, as the partner has to build the production plant first. Anyway, 5 new contracts until 2030, plus the royalties that will start to come from contracts signed in 23 and 24 would see revenue increase materially.

Overall, by 2030, management targets to generate over €150 million in total revenue.

In the short-term, Hoffmann has still to invoice €10M from the USA entry fee, plus €1.5M from an entry fee in the U.K. The company reported €13.8M in trade receivables on the balance sheet, this is, more or less, the same amount expected to be invoiced from international entry fees. Furthermore, H1 25 cement volumes reported (19.6k t) already outperformed its total 2024 volumes (16.2k t), so what could be the total volumes for FY25? During H1 25, the company signed or extended 4 new contracts with french construction companies, and management reported that it’s cement is ‘in growing demand in several promising segments across France, including industrial buildings and logistic platforms, outdoor landscaping, underground network installation, waste treatment, telephone masts and public road works.’

Let’s say the new contracts, plus demand from other sectors apart from homebuilding, adds 10k tons for H2 25, that’s ~30k tons for the full FY25. At 160€/t, that’s ~€4.8M in cement sales (FY 24 cement sales €2.7M). To this we could add the €13M from entry fees still pending from the USA and U.K contracts, and that gives a total revenue for FY25 of €17.8M 34% increase vs. FY24.

On the FY24 annual report it was stated that: ‘The license agreement with the American partner Hoffmann Green USA was extended in December 2024, triggering an additional entry fee of €8 million’, but this was not reported as revenue contribution for that year 2024. Because it seems a subsidiary, we could count some part of it to be invoiced in FY25 as well, but maybe not the total amount. So, I think the company has real possibilities to reach €20M in revenue for FY25 (+51% growth).

Another think to bear in mind is the importance of the order book. Which has increased from 200k tons in 2021 to 360k in 2024.

On the profitability side, costs for FY24 where 43% higher than revenue (incl. D&A). Excluding D&A they where only 12% higher. For FY23, costs excluding D&A where 98% higher than revenue. FY24 EBITDA was €-700k, up from €-5M in FY23. Overall, it seems the company is on the path of operating break-even for this year or the next one.

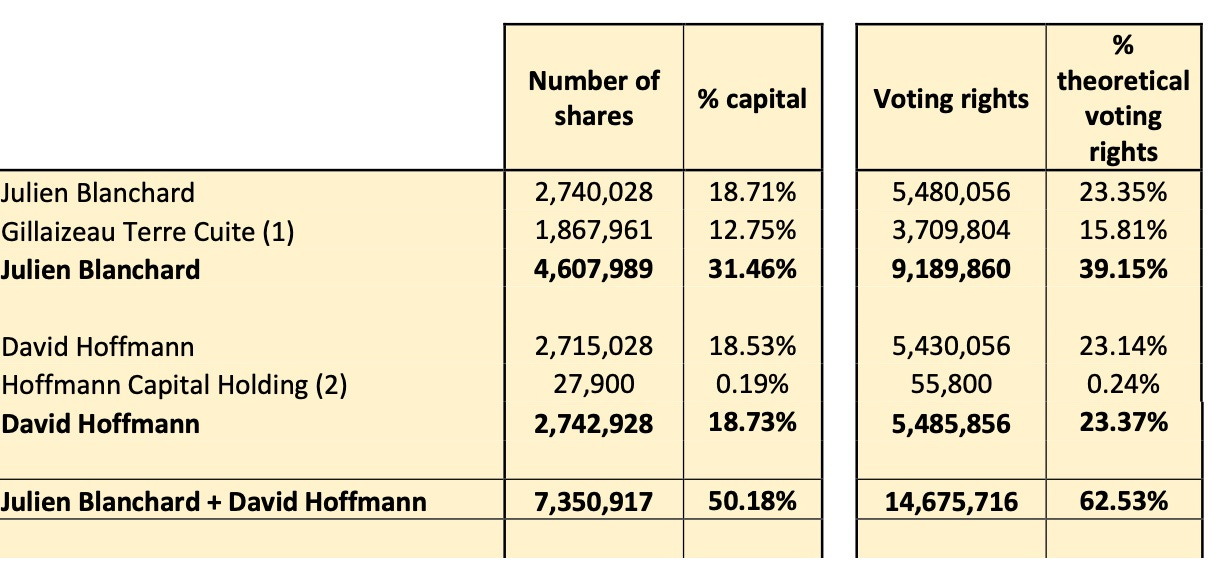

Major shareholders

Both founders of the company, J. Blanchard and D.Hoffmann own more than 50% of shares combined. A company called Euldom owns 5.8% of shares and employees own 0,32%.

Conclusion

Hoffmann is a growth company in a mature and unsexy industry. The global cement production is dominated by a handful of world leaders. In France, for example, 95% of cement production comes from five major players. Cement production in France was ~16 million tons in 20241, if Hoffmann produces 30k tons this year, that would mean ~0,18% market share. By 2028 french cement production is forecasted to grow at 2,7% CAGR. this implies 17,8M tones of cement produced. Hoffmann has the ambition to achieve 6% market share in France by 2030. Let’s say by 2028 it’s market share is 3%, that’s 530k tones. At 160€/t = €84.8M FY28 revenue from cement sales (excluding entry fees and future royalties). Sounds reasonable?

share price chart 5Y (Fiscal.ai)

Hoffmann IPO’ed in 2019 at €18/share. It’s share price reached €36 in 2021, followed by an -80% drawdown from it’s peak. YTD, the share price is -25,5% down. The market was wrong with expectations back then. Maybe cement substitution was a hot topic in 2020-21, but momentum faded away. Is now the time to revisit the ‘cement substitution’ investment thesis?

Thank you for reading!

Disclaimer: this are just notes I like to share, not investment advice.

https://www.indexbox.io/store/france-cement-market-report-analysis-and-forecast-to-2020/

Thanks for the piece!

A few questions jump out at me:

1. Is Hoffman "cement" a 1-for-1 replacement for Portland cement?

2. What is unit cost compared to conventional cement?

3. Do sales rely on the green angle? Are any government subsidies/regs involved, either directly or indirectly?